Wealth management firms have an opportunity to attract women advisors whose breadth of perspectives can better serve affluent women and diverse clientele, a recent report said.

As the wealth management industry prepares for the great wealth transfer that will put mass wealth in the hands of women, firms should shore up their hiring of women advisors, according to a McKinsey & Co. report released in May.

“With many independent financial advisors nearing retirement, firms have a chance to attract a new generation of female advisors and corporate leaders whose experiences and perspectives can inform their approach to affluent women,” the report said, calling women clients the “new face of wealth.”

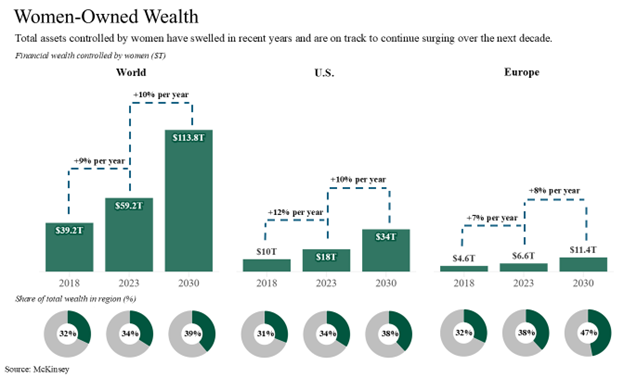

From 2018 to 2023, total assets controlled by women in the U.S. rose to $18 trillion from $10 trillion. That number is projected to surge to $34 trillion by 2030, representing 38% of total U.S. assets, according to McKinsey. Meanwhile, women make up just 23% of the U.S. financial advisor workforce, according to McKinsey statistics, and that number hasn’t budged in recent years.

“When we wrote the initial article on this topic five years ago, we hoped there would be more progress, but the results do not yet speak for themselves,” Meg Sreenivas, an associate partner at McKinsey and an author of the study, told Financial Advisor IQ in a statement.

“If the industry is to make a shift,” Sreenivas added, “a few outcomes could be: significantly more assets under advisement, higher client and asset retention (in particular after ‘money in motion’ events where women tend to change financial advisors, like the death of a spouse), longer lifetime value for clients, and higher satisfaction for clients of all genders.”

At &Partners more than one-third of advisory teams have a woman on the team, and 25% of the teams were founded by women.

Kristi Mitchem

Founding Partner, &Partners

Kristi Mitchem, a cofounder at &Partners and a former executive at Wells Fargo, said that industrywide statistics are difficult to nail down, as many firms don’t release figures on internal demographics. At &Partners — a hybrid registered investment advisory firm launched in 2023 by several former Wells execs — more than one-third of advisory teams have a woman on the team, and 25% of the teams were founded by women, Mitchem said. Among those women practice founders who joined the firm through May of this year, the advising teams had a median team production of more than $2.4 million, “making them some of the most successful advisors in the United States,” Mitchem said.

“So not only are women team members, women are team leaders at &Partners, and I think that is just sort of a great way to show the power of women and their ability to be incredibly successful in the context of financial advisory work,” Mitchem said. “There’s no question to me that we have been successful in recruiting more than our fair share of women advisors.”

McKinsey reported that diverse advisor teams are seen as better equipped to handle an “evolving client base.” They’re also seen as “better able to retain female clients during major life events such as divorce or widowhood, key moments at which women are most likely to switch advisors,” according to the paper.

“I think there’s no evidence that shows that women choose women advisors with any consistency, but what they do choose is teams that represent a diversity of perspectives,” Mitchem said. “I think the research shows that women want to be heard. They want to be understood. They want to be a name, not a number.”

I think a lot of teams these days have started to realize that there’s value in having a woman sitting amongst the group. When you’ve got more people on your team, you have that ability to play to the client. What does the client need? What’s going to make the client feel most comfortable? It’s an advantage.

Nancy Bach

Founder, Advisor, Cottage Wealth Advisors | &Partners

Nancy Bach, an advisor and founder of Cottage Wealth Advisors in Evansville, Indiana, which is under the &Partners umbrella, said women are sometimes more equipped to bring empathy to conversations about wealth that can be emotional and stressful.

“I think a lot of teams these days have started to realize that there’s value in having a woman sitting amongst the group,” Bach said. “When you’ve got more people on your team, you have that ability to play to the client. What does the client need? What’s going to make the client feel most comfortable? It’s an advantage.”

According to McKinsey’s analysis, recruiting more women advisors will be “an essential part of capturing the opportunity in female-controlled wealth, but diversity goes beyond gender.”

Mariam Adams, a financial advisor at UBS’ The Adams Group in New York City, said the fact that most advisors are older white men is more than a diversity issue; it’s a business issue.

“There’s a saying in our business that as an advisor, your client base starts to look a little bit like you,” Adams said. “I like to say that I am the trifecta, the outlier in this business: I’m a person of color, I’m a woman and I’m also part of the LGBTQ community. So it’s really these marginalized communities that are reaching out to me because I don’t think there are a lot of advisors that look like me.”

Reprinted with permission.