It’s never easy for advisors to make the decision to change firms. When considering a move, advisors focus on a host of issues as they search for a place where they, their teams, and their clients can truly thrive. Historically, most advisors transitioned from large firm to large firm, because the advantages of scale within the industry made it difficult to choose smaller, independent platforms. And then something changed.

Technological innovation and the advent of cloud-based computing brought about a revolution in wealth management. Today, advisors can team up with other advisors to form boutique wealth managers without sacrificing the benefits of scale. Consequently, advisors are now increasingly moving away from the large wires, favoring firms that uniquely reflect their values and fully embrace their approaches to planning and investment management.

Certainly, some independent boutique firms will be successful without broadly distributing equity, but those built on the premise of majority advisor ownership are likely to dominate in this new world. Shared ownership is compelling to advisors who want to shape their own futures and capitalize on the value that they create. However, to reap these benefits fully, advisors must affiliate with organizations that can differentiate themselves and grow at above market rates.

A model for evaluating independent firms

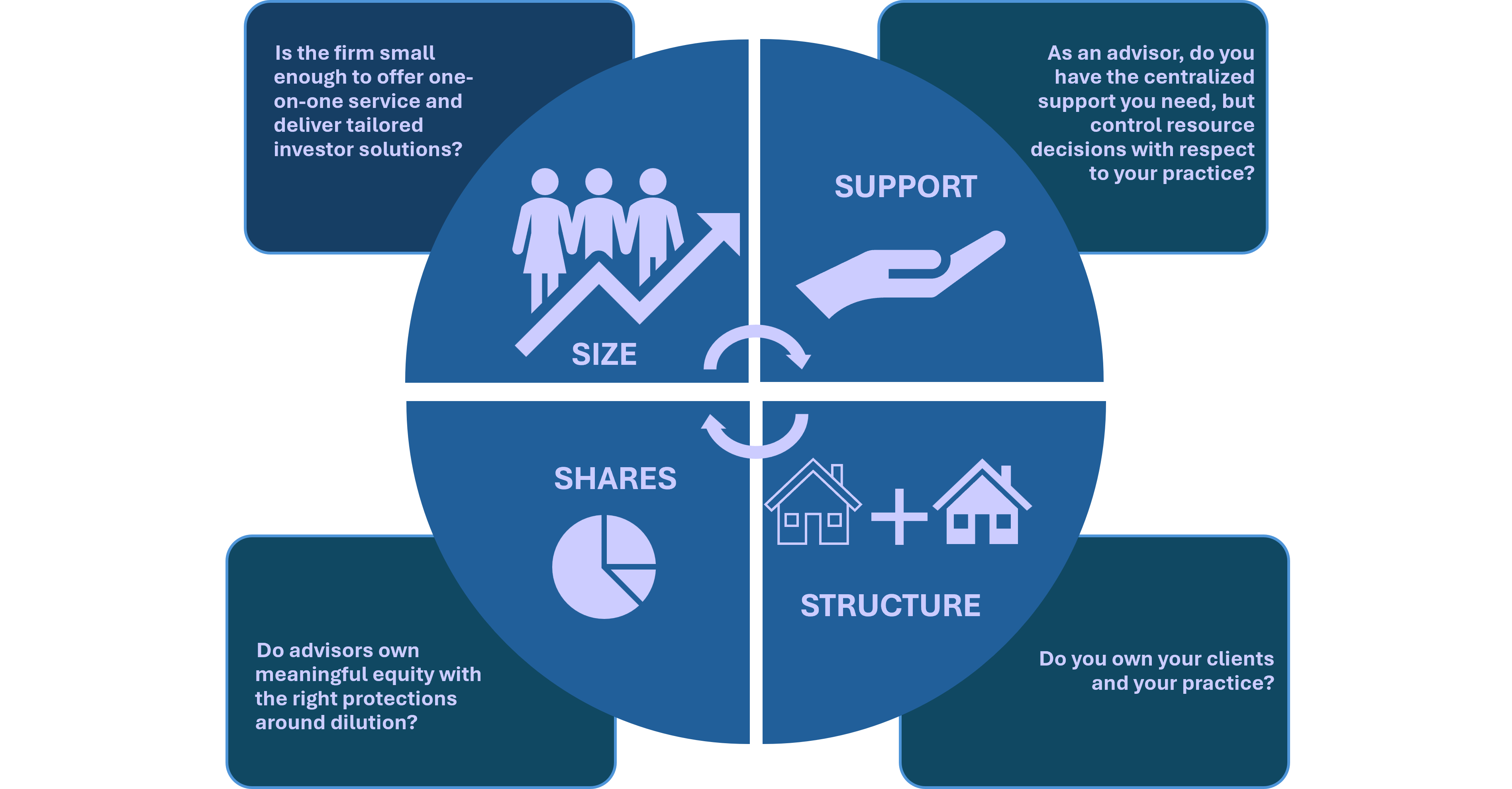

In my view, the most successful players will be highly intentional about the decisions they make with respect to size, support, structure, and shares (the Four S Model). Analyzing a firm’s decisions with respect to these four factors can help advisors evaluate the potential of the independent firms they are considering.

Factor 1: Size

It is important to get the size question right. When I first considered starting my own firm, my initial thought was to build something with 20 to 30 advisors that I knew well. Having been at a large wirehouse for most of my career, I wanted to avoid the kind of lowest common denominator decision-making that reigns at firms that focus on protecting against what advisor 14,999 might do at the expense of both the advisor and client experience.

But I quickly recognized that teaming up with a handful of practices would not be optimal because there were meaningful disadvantages to being too small, particularly in terms of reduced leverage with key providers around cost, scope of services, and more. I came to believe that the best firms should feel like scaled boutiques — small enough to know each other but big enough to matter.

Because size impacts so many things — from service and supervision to culture and profitability — winning firms should be able to articulate how they came to their “Goldilocks” number.

The winners in this new era of wealth management will make intentional decisions with respect to size, support, structure, and shares that reflect their unique models and evidence a high degree of internal consistency.

John Alexander

&Partners LLC

Factor 2: Support

A common tendency among newly founded firms is to engage in bootstrapping or, said another way, self-funding. Unfortunately, self-funding often results in a flatter growth curve and makes it difficult to achieve excellence early on due to strained resourcing and limited capital for recruitment. For this reason, it’s not a strategy that I think works.

In my view, it’s critical to get comfortable with a significant initial investment in the business to deliver for advisors and their clients. That means raising sufficient equity capital and accepting operating losses in the first few quarters.

Part of an advisor’s diligence prior to joining any firm should be to pressure-test the following:

- Quantum of capital raised and its sufficiency with respect to expected recruitment

- Breadth and depth of key functions such as operations, supervision, onboarding, and recruitment

- Robustness of the financial model given the critical role that accurate forecasting plays in ensuring capital adequacy — be wary of self-funded “lean and mean” pitches

Profligate spending should be avoided, but intentional investment should be embraced.

Factor 3: Structure

Structure is sometimes overlooked, but it’s critically important, particularly as it relates to who owns the client. In some independent firms, advisors own their clients, and in others, the firm owns the clients.

I have always believed that advisors are best positioned to determine what is optimal for the individuals and institutions they serve. As a result, advisors should exercise full control over critical decisions such as the number of staff they employ and the real estate footprint they occupy.

To me, best in class from a structural perspective is the adoption of a two-asset model — where advisors own their practices (asset 1) and a piece of the platform they join (asset 2). This two-asset model empowers advisors through ownership of their practices and creates alignment with the broader franchise through advisors’ participation in platform economics.

Factor 4: Shares

There is surprising variability in the equity plans currently on offer in the advisory space — in terms of both the quantity and quality of equity offered. In many cases, advisors joining RIAs and hybrids participate in a small piece of the economics, with larger equity pools going to executives and capital providers. In other newly minted firms, the equity granted can be substantial but doesn’t come with protections around dilution — meaning equity-based financial benefits to inaugural advisors could be limited.

Advisors making the move away from wires should look for transparency around the way equity awards are sized. They should also seek out firms where management and advisors are granted the same class of shares. I would also recommend heavily discounting conditional equity offers and those from organizations without protections against dilution.

Shared ownership can drive future success, but it only creates lasting value if the equity promise can be realized.

Figure 1: Four S Model for evaluating independent firms

Proving a picture is worth a thousand words

Whether you credit Leonardo da Vinci, Confucius, or modern-day ad executive Fred Barnard with the saying, I think we can all agree that “a picture is worth a thousand words.” I’ll close by offering a graphic that summarizes the Four S Model for evaluating opportunities in the independent space.

I believe that the way in which a firm approaches questions with respect to size, support, structure, and shares is revealing. For example, an organization with an aspiration for unlimited growth and a commitment to service excellence is likely to fail to achieve either, because it is difficult to sustain white-glove, one-on-one service models as you scale. Similarly, firms espousing high levels of client centricity while claiming ownership over clients may not truly value the primacy of the advisor-client relationship.

The winners in this new era of wealth management will make intentional decisions with respect to size, support, structure, and shares that reflect their unique models and evidence a high degree of internal consistency.

Applauding the fintech revolution

In my view, we should all applaud the technological innovation that we are witnessing in our industry, because it has the potential to enhance the value that financial advisors can offer their clients. Advisors today are free to affiliate with firms that fit them — philosophically, culturally, and operationally. Size is not a factor that limits the advisor’s choice set.

Thanks to the democratization of technology, big is no longer better. The question is simply how to identify and team up with the best.

John Alexander is managing cofounder of &Partners, a St. Louis-based wealth management firm for advisors seeking equity participation, institutional support, and access to a collaborative peer network.

Reprinted with permission from Financial Advisor IQ ThinkTank.